The Global Shift Toward Electric Vehicles

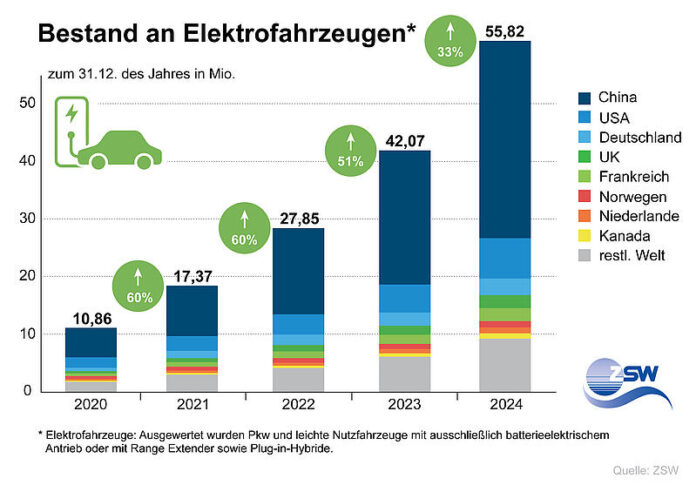

Electric vehicles (EVs) are increasingly shaping the future of transportation. Driven by climate goals, technological innovation, and consumer demand, countries around the world are pushing for greener mobility solutions. According to the International Energy Agency (IEA), EVs are crucial in reducing CO₂ emissions and fossil fuel dependency. The year 2024 marked a significant step forward in this transition, with nearly 56 million electric cars on global roads. Yet, as some markets accelerate, others show signs of slowing down. This shift reveals the complexity of global EV registrations, where policy, market size, and infrastructure all play key roles. The Centre for Solar Energy and Hydrogen Research Baden-Württemberg (ZSW) has been looking at the current figures on electromobility.

Record-Breaking Growth in EV Adoption Led by China

In 2024, global new EV registrations hit 17.4 million — a 17% increase over 2023. This includes battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and models with range extenders. China dominated the landscape with over 11 million new EVs, reinforcing its leadership in clean mobility. The United States followed with 1.6 million, and the EU reached 2.4 million new registrations. Smaller nations like Denmark and Canada also saw impressive growth rates of 44–46%, highlighting the increasing global momentum behind EVs.

Europe’s Slower Climb and Germany’s Setbacks

While Europe remains a key player, Germany’s momentum slowed significantly. The country registered only 572,500 new EVs in 2024 — a decline for the second year running. A major contributor to this drop was the abrupt end of incentive programs. Germany currently has 2.6 million EVs on the road, far below its 2030 target of 15 million. In contrast, Norway continues to set benchmarks, with 8 in 10 new cars being electric thanks to stable incentives and long-term infrastructure investments.

U.S. and Global Manufacturers Struggle to Keep Pace with China

Though American giants like Tesla remain strong, they are falling behind Chinese manufacturers. BYD leads with over 10 million EVs sold, followed by Tesla at 7.3 million. Germany’s VW, BMW, and Mercedes are in the global top 10 but face increasing pressure from rising Chinese brands like Li Xiang, Changan, and Seres. In fact, 6 out of the world’s top 10 EV manufacturers in 2024 were Chinese, and 8 of the 10 most registered EV models also came from China — spanning all vehicle segments.

The Road Ahead – Broader Appeal and Cheaper EVs Needed

Looking forward, European manufacturers need to act quickly to remain competitive. Experts suggest introducing more affordable EV options and enforcing CO₂ limits for corporate fleets. Incentives targeting used EVs and private buyers could also stabilize the market. The future of electromobility depends not only on innovation but also on consistent government support and consumer-friendly policies. The EV transition is no longer just about technology — it’s a global race influenced by economics, policy, and consumer trust.