Electric vehicles (EVs) dominate global markets in 2025, with 12.8 million highly electrified vehicles sold in the first nine months across China, Europe, and the US. China leads strongly, registering 8.89 million new energy vehicles (NEVs) and achieving a 52.4% market share. Meanwhile, Europe sees 27.7% growth in BEVs and plug-in hybrids, reaching 27.4% market share. For instance, Germany reports 46.6% increases in electrified sales. These trends highlight EVs’ critical role in sustainable transport, from passenger cars to commercial fleets.

EV Motors Drive Rare Earth Magnet Growth

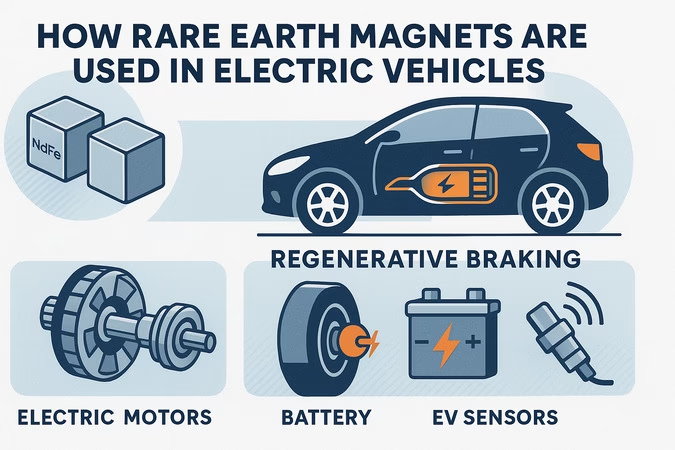

IDTechEx predicts global rare earth magnet demand will hit 332 kilotonnes per annum by 2036. This marks a 70% jump from current levels. Electric vehicles spearhead this surge. They will hold over 70% market share for rare earth permanent magnet motors through 2036. Demand for these magnets in EVs will double in the next decade. Moreover, automakers face 2025 supply disruptions. As a result, they seek alternatives to these critical materials. However, EVs remain key, using magnets in drive motors, power steering, and speakers. Passenger cars need several kilograms per unit. Commercial vehicles require hundreds.

Rare earth magnets enable high-efficiency EV motors. They provide strong torque and compact designs. For example, BYD and Geely lead BEV sales growth, with 37% and 90% increases respectively in 2025. Tesla faces slight declines, yet the sector expands. Transitioning smoothly, these applications extend beyond cars. EVs integrate into smart grids via vehicle-to-grid tech. This boosts energy stability. Thus, rare earth demand ties directly to EV adoption barriers and innovations.

Wind Energy and Robotics Boost Demand

Wind power will claim 20% of global rare earth magnet demand by 2036. Larger turbines drive this trend. In 2025, offshore models exceed 310-meter rotor diameters and 26MW capacity. By 2030, onshore hits 20MW, offshore 35MW. Consequently, magnets support bigger, more efficient generators. Additionally, humanoid robots emerge as a growth area. Each unit averages 40 motors. Over 95% contain rare earth permanent magnets. Therefore, industrial automation accelerates magnet needs.

These sectors complement EV growth. For instance, IAA Mobility 2025 showcased EV battery advances alongside wind tech synergies. However, supply chains face risks. China dominates production, but expansions occur in the US, Europe, and Asia-Pacific. By 2034, output exceeds 300,000 tonnes annually. Still, disruptions prompt diversification efforts.

Supply Challenges and Future Outlook

Global production ramps up steadily. New facilities emerge outside China. Yet, 2025 disruptions challenge automotive firms. They pivot to magnet-free alternatives. Despite this, forecasts remain optimistic. EVs maintain magnet dominance due to performance edges. Furthermore, robotics and wind installations add momentum. Overall, demand outpaces supply short-term. Long-term, capacity builds confidently.

Policymakers and firms address vulnerabilities. Europe invests in domestic mining. The US boosts incentives. Meanwhile, recycling advances reduce reliance. In EVs, next-gen motors explore ferrite options. However, rare earths prevail for efficiency. Thus, balanced strategies ensure growth. EV applications thrive amid these shifts, powering sustainable mobility worldwide.